Blockchains and the Digital Commons

An outsider-friendly guide to understanding what blockchains and "crypto" truly are

Part 0. Why write this?

As someone who has spent a significant amount of precious free time looking into the world of blockchains, trying to “get it”, I have felt the pain firsthand of trying to grapple with technical complexity, terribly articulated explanations, cryptic jargon, and abbreviations that often encodes more than they decode.

What’s worse, is in my opinion even experts who understand blockchains well often fail to communicate their essence effectively, overestimating their audience’s context and background knowledge, leaving their explanations filled with logical leaps and omitted crucial details under the false pretense that they’re universally understood. As it stands today, there’s no getting around the fact that it requires significant, deliberate effort to understand blockchains’ function and their purpose, which keeps the field unnecessarily esoteric.

This in turn fosters an environment where almost everyone has extremely little context as to what blockchains are, their ties to cryptocurrencies, and their significance as a technological advancement. After all, most people are busy and don’t care nor have the free time to pore through random articles and papers about blockchains (which is fair). Unfortunately, though, this educational gap allows click-baity, surface-level narratives to dominate the societal mindshare surrounding blockchains, leading lot of people – from casual observers and tech enthusiasts, to academics and critics – to either incompletely grasp the technology’s benefits, or dismiss the entire field as overly complicated, irrelevant, useless, or even an outright “scam”.

The stereotypical “guy rambling about blockchain at the party” has evolved into a bit of a meme, another symptom of the common perception that, while there is some palpable sense of enthusiasm surrounding blockchains, it’s challenging to actually articulate an organized flow of how and why they work without ending up looking like this:

This is because not only are their technical details tricky, but conceptualizing why blockchains are even being built at all is yet another challenge, as it can require a reframing of the prevailing dynamics that the world of software currently follows.

I myself am definitely also guilty of looking like the guy above, which is in part my motivation for this article — to distill my thoughts and explain things clearly.

Surprisingly, there isn’t any resource out there (that I’ve been able to find) that succinctly captures the true essence of blockchains for those completely inexperienced to them, which is why my goal for writing this article is to address that gap by providing a digestible, comprehensive explanation of why blockchains matter and how they fundamentally work, aimed specifically at those of us who have a life and don’t have the time, energy or desire to sift through all of the disjoint information out there. This means that I’ll be including everything I consider crucial background context for digesting the space to the fullest, including many key points that are almost always left unsaid in conversations surrounding blockchains.

Lastly, I understand that recent events and media coverage has essentially synonymized the term “blockchain” with “scam” in many people’s minds, and the term “crypto” has become charged to the point of being a dirty word due to its association with schemes. I definitely empathize with this skepticism, though ultimately I believe it lacks sight of a bigger picture. This negativity is not a reflection of the technology itself, but is rather a testament to our collective lack of understanding of blockchains, coupled with the fact that blockchains can actually harbor real-world monetary value, which has enabled a fertile ground for con-men, opportunistic scammers, grifters, hackers, and other unsavory characters to proliferate.

It's worthwhile to remember the infancy of the internet, when it was similarly riddled with email scams, identity theft, credit card fraud, phishing scams, and other criminal activity. Did we discount its potential, and its disruptive power because of these initial stumbling blocks? No, and just as we did not "throw the baby out with the bathwater" then, it’s short-sighted to do so now. The problem isn't with the technology, but with our perception of it, and if its potential was better understood, perhaps we’d find ourselves engaging in a different dialogue about it. I believe there are many people out there who would be interested in blockchain tech if they better understood what blockchains can accomplish, but instead are vehemently opposed to them due to the negative sentiment surrounding them.

As you might be able to tell, I’m optimistic about blockchains, and as you’ll later see I think they provide us with a unique opportunity to push back on entrenched forms of power online. My hope is that this writing might inspire a fresh understanding that accurately reflects the field’s potential. The tech, maligned though it is, shouldn’t be seen as a threat, but rather an opportunity – a tool to construct novel systems capable of achieving previously impossible tasks.

Now, before diving into specifics, which will come soon, I would like to preemptively address two major misconceptions that provide a useful frame of reference:

Blockchains are not inherently financial

Cryptocurrency is an enabler of blockchain technology, not vice versa.

With that, let’s get into the details, starting from square one.

Part 1. Byzantine generals

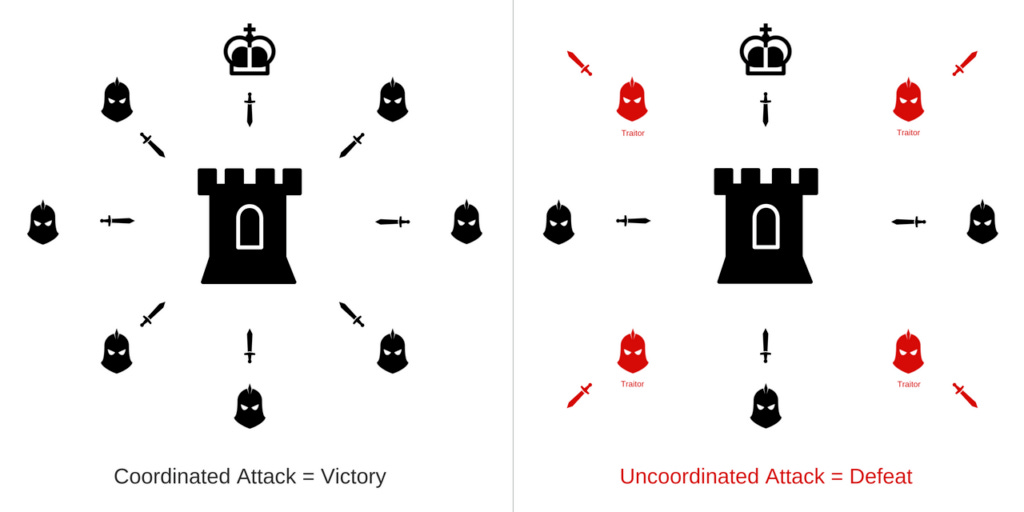

Firstly, we need to familiarize ourselves with a famous, long standing problem in computer science: the dramatically named “Byzantine generals problem”. Here's the premise: Byzantine empire generals surround a city, and must coordinate their attack such that enough charge at the same time, otherwise they face defeat. With no unifying commander, they must communicate with each other via horseback notes carrying orders to either advance or retreat. But there’s a catch – some generals are traitors, and will try to cause confusion by sending conflicting notes and intercepting honest notes in hopes to ruin the coordinated effort.

Funnily enough, this predicament exactly mirrors the challenge that computers in a network face when trying to come to any consensus without a central leader. Just as traitor generals exist, we all know the online world is certain to have its share of bad actors. And just as traitor generals can send conflicting notes and intercept honest ones, a bad actor online can disrupt digital communications across the network and exploit vulnerabilities to sabotage communication between honest network members.

Thus, we can say that the Byzantine Generals Problem (BGP for simplicity) asks this fundamental question: "How can a network of individuals reach consensus on something without a trusted central authority?"

As it turns out, this is a really tough question to answer. Since it was first identified about 50 years ago, numerous theoretical solutions have been proposed, but none were practical for real world networks due to their reliance on some form of centralized control, leaving the BGP ultimately unsolved for many years.

In a turning point, the emergence of Bitcoin in 2008 presented us with a solution. For the moment, set aside any thoughts about coins, tokens, or money. Bitcoin’s true technological breakthrough was this: it demonstrated, for the first time, that a network of anonymous individuals could reach consensus without needing any central authority (we’ll discuss how it achieves this soon). This breakthrough then marked the beginning of a new field in computing based entirely on leveraging Bitcoin’s novel underlying technology – now known as blockchain technology – to construct a new class of digital networks and systems.

If we wanted to, we could stop here and simply say that blockchains are a breakthrough because they allow us to “reach consensus online without a central coordinator”, and leave it at that. Yet, this is clearly an unsatisfying place to stop, as the implications of that feel pretty abstract and immaterial, unlikely to be an “aha!” moment for anyone. I’ll delve into what interesting things we might actually do with this new capability later, but first it’s essential to go over how blockchains are able to achieve their magic property of leaderless consensus, and hopefully dispel some common technical misconceptions along the way.

Part 2. Blockchain anatomy

The general idea

We can gain a clearer understanding of exactly how blockchains attain leaderless consensus by viewing them as a trio of interconnected components: the state, the protocol, and the consensus algorithm. At a high level, each component has a relatively straightforward purpose:

The state is the subject matter on which the network seeks consensus – the enshrined crown jewel that exists at the center of the system. For instance, in the Bitcoin network, the state is a comprehensive, ordered list of all Bitcoin transactions that have ever happened. But, the state of a blockchain could be literally anything. As a random silly example, we could, if we chose, create a blockchain to reach consensus on the state of a tic-tac-toe board and its transitory changes.

The protocol is the set of rules governing how the state is allowed to evolve over time. Using Bitcoin again as an example, its protocol includes basic rules such as prohibiting spending more coins than you have, or spending someone else's coins. Just like the state, the protocol can encompass any set of rules. The hypothetical tic-tac-toe blockchain's protocol would simply be the established rules of tic-tac-toe.

The consensus algorithm is the process that ensures everyone in the network agrees on the same state, and follows these steps:

To begin, everyone maintains a personal copy of the state

One participant is selected at random and given the opportunity to make any alteration to a previous state (known as a block)

The change is shared with everyone else in the network who, upon verifying that it adheres to protocol rules, update their own copies accordingly

This repeats indefinitely at a set interval

By definition, each block must be derived from changes from a previous block, which we can conceptualize as a chain-like continuity — hence, the term blockchain. Importantly, each network member, once randomly selected, actually has the freedom to build a block on top of any previous block in the chain they choose. Zoomed out, this results in the overall structure of the blockchain resembling a branching tree, representing various versions of the state’s history, rather than a single straight line. The "consensus" portion of the algorithm is simply an encoded rule that states that whatever is the longest branch following protocol rules the whole way through is the "true" state history that everyone must agree upon.

Anti-Sybil mechanisms

Remember, the goal of this system is to achieve consensus without a leader, despite some of the population being “traitors” – or participants actively trying to ruin consensus. The consensus algorithm described above might seem robust, but it has a big weakness, which is that in the online world, it’s easy and inexpensive to generate a swarm of bots, which renders the crucial consensus algorithm step of “randomly selecting a participant” extremely vulnerable.

What’s stopping a motivated bad actor from creating a bunch of bots to represent themselves, winning a disproportionate amount of these “random” selections, and ruining the consensus party? In the current description of the system I’ve provided, there would be nothing stopping this. If someone succeeded in seizing control in this manner, the blockchain’s fundamental property of "leaderless consensus" would be nullified. We would find ourselves in the presence of a network with a de facto leader – a system we already know how to run just fine without needing a blockchain in traditional networks today.

This conundrum ties into what’s known as the Sybil problem, another unsolved problem in computer science. In short, the Sybil problem says that there’s ultimately no foolproof way to differentiate between a bot and a real person online.

Although there are ways to get a decent guess if you’re a real person (like captchas, email signups, and activity monitoring), at the end of the day, it’s still impossible for even the wealthiest tech giants to keep bots off of their platforms completely.

To circumvent this issue, blockchains use what’s called an anti-Sybil mechanism as a crucial part of their consensus algorithm design, which essentially places a tangible limit on the amount of influence a single person can wield in the network. Several such mechanisms exist today, but the original one used by Bitcoin is called "Proof of Work" (PoW), which takes advantage of a specific type of problem that computers can only solve by guessing a huge amount of numbers (i.e. doing a lot of work). This allows the consensus algorithm to then probabilistically mimic “random selection” by granting the next block to the first network participant who correctly guesses a correct answer.

By doing this, PoW is able to significantly restrict a single person’s chance of being selected down from the number of bots they can create, to the amount of resources (i.e. electricity and computing hardware) they can expend. While this method has its valid critiques, it is undeniably a more accurate measure of personhood than treating each account – which could be a bot – as an individual. The rationale is straightforward: unlike bots which can be created virtually limitlessly, there is a finite limit on how much electricity one person can feasibly harness at a given time.

Now, is PoW using electricity as a proxy for identity a perfect solution? Of course not. For one, a dedicated wealthy actor could still feasibly harness enough electricity in a PoW network to disrupt consensus. Secondly, the sheer waste of energy caused by PoW at scale, where hundreds of thousands of powerful machines worldwide chug as fast as they can 24/7 to guess an unfathomable amount of numbers, is of course done at a huge expense to our already jeopardized global environment. For many people, myself included, this waste is unacceptable, and we need something better.

Fortunately, there are newer anti-Sybil mechanisms that don’t waste energy in this way, namely “Proof of Stake” (PoS). PoS operates similarly to PoW, but instead leverages the fact that electricity itself is effectively a proxy for capital. Rather than using external electricity, in PoS, a blockchain’s internal token is used as a proxy for identity, eliminating the need to expend wasteful amounts of energy to secure the network.

Maybe, if someone someday solves the Sybil problem and invents a magic way of proving humanity online without needing a central authority, we could make a new anti-Sybil mechanism and call it something like “Proof of Personhood”, allowing us to ditch using proxies for identity in consensus algorithms altogether, improving blockchains even further.

Incentivization

I briefly mentioned that blockchains have “internal tokens”, but what does that mean exactly?

First, a bit of background: in PoW participants obviously foot a huge electricity bill, and in PoS participants lock away their assets, presenting opportunity cost. Blockchains fundamentally depend on there being people willing to participate in their anti-Sybil mechanisms for their security, but participating in these mechanisms is costly for individuals. And it’s not reasonable or secure to expect people to do it from the warmth of their hearts.

Unfortunately, blockchains cannot solve this problem by printing real-world currency to incentivize participants. What they can do, though, is establish an internal token that lives within the confines of the network, and dish it out accordingly.

Is this token actually worth anything? Well, it depends. In Bitcoin’s case, bitcoins are given out as rewards to anti-Sybil participants (in PoW they are called miners), but the tokens themselves don't actually possess any intrinsic value (sorry): they’re just tokens that do nothing, and critics have accurately deemed them pet rocks for this reason. Yet, bitcoins have miraculously managed to reach “escape velocity” despite this fact and capture enough societal mindshare and recognition to generate some kind of shared social perception of value. In contrast, some other blockchain tokens actually do have an intrinsic purpose, an interesting concept we’ll explore soon.

Anyways, the main takeaway for now is that a blockchain must give out token incentives to support participants in its anti-Sybil mechanism, thereby ensuring it is expensive for an attacker to take over the network on their own, thereby securing the blockchain’s consensus ability. Every blockchain must have its own internal token to facilitate this.

This is the crucial link between blockchains and cryptocurrencies that is so underemphasized: all blockchains require an underlying cryptocurrency to allow their unique leaderless consensus powers to be secure. In other words, it’s not blockchains that enable cryptocurrency, it’s the other way around. Cryptocurrency is the means, not the ends – it’s a tool that facilitates the functionality of leaderless consensus that we really want, by encouraging people to contribute to the network’s operation through the anti-Sybil mechanism.

Part 3. Ultra Permanence

There is a profound consequence that comes from consensus without a centralized leader. Since nobody in a blockchain has the power to dictate what a blockchain’s state is by themselves, nobody therefore has the power to undo changes to the state once they are made. Interestingly, this produces a type of ironclad permanence to a blockchain's state that's unparalleled in the digital world.

Every single conventional app and database today has someone, somewhere that has the keys to delete or modify things if they wish, but by definition, this is not the case for blockchains, and such a person doesn't exist. This in turn gives blockchains a secondary superpower — true digital permanence — to complement their leaderless consensus.

Blockchain security

Before we go further, it’s important to not get carried away, and highlight that blockchains are in fact not magic, and it’s worthwhile to scrutinize what their practical limits truly are when it comes to maintaining consensus and resisting so-called “traitor generals”.

Remember, the absence of a central authority in any open online network inevitably leads to some portion of users having malicious intent, and that blockchains allow the formation of networks where honest members can achieve consensus despite the presence of these bad actors. Nevertheless, there does exist a critical threshold where if enough of the network is malicious, even a blockchain will capitulate, and honest members can no longer be sure whether the agreed state truly reflects honest members' collective decision-making.

For most blockchains, this percentage is 50% (though this can be stretched to 66% with technical design compromises). The good news, however, is that as long as the malicious percentage of the network is below the given threshold, all honest members can be certain that consensus is held.

Hypothetically, if an attacker did manage to breach the threshold, they could hijack the entire network. Remember, the consensus algorithm dictates that whatever branch in a blockchain is the longest is the one everyone must agree upon. It follows that if one entity can create over 50% of the blocks, they can always make a branch longer than the rest of the network combined. Other members, bound by the consensus rule, would be forced to accept the attacker's branch, compromising the entire blockchain network.

I previously mentioned that in blockchains, no one can undo state changes once they have been made. There is an asterisk on that statement because it breaks if somebody actually does have the power to dictate the state for themselves, i.e. if they pull off a successful attack. By creating a new longest branch off an old block, an attacker can revert the agreed state to a version where none of the later changes ever happened, making those blocks un-permanent. In the most extreme case, they could even base a new branch on the first-ever block, effectively erasing the entire history of the blockchain.

Luckily, to actually pull off an attack and breach that threshold, it would require there being a dedicated attacker willing to invest heavily in harming the network, and the financial burden of doing this can be massive, particularly as the size of the blockchain network and its number of anti-Sybil mechanism participants increases. Early-stage blockchain networks are indeed relatively vulnerable to attacks, but at a certain level of maturity, large blockchain networks – like Bitcoin and Ethereum (which we’ll be examining later) – have enough resources committed to their respective anti-Sybil mechanisms such that an attack would cost billions of dollars.

Now, this all might still seem a little precarious to you, and these potential vulnerabilities of blockchains might seem unsettling — rightly so. After all, there always might be someone out there rich and powerful enough to control even the biggest blockchains past their threshold if they really set their sights on it, from eccentric billionaires to the most powerful governments.

Fortunately, there is a bright side! Revisiting PoW, a successful attack would indeed mean that the network is as good as dead, and we can pack our bags. The attacker, leveraging electricity external to the blockchain, can sustain their attack indefinitely, and there’s nothing we can do to make the attacker go away.

Conversely, in Proof of Stake (PoS) networks, an attack doesn't signify the end. In fact, PoS networks can actually weather successful attacks and emerge with minimal damage.

Why is this so? In PoS, the attacker must use tokens internal to the blockchain, rather than external electricity, to attack the network. As a result, the humble users of the blockchain have the capability to clearly identify the attacker, and manually forge a new branch where their tokens are gone, and resume the network from there. This wouldn’t be an automatic process and falls outside the scope of the automated consensus algorithm (since the attacker would have breached the 50% threshold), so this reboot would require a concerted community effort, and might prove lengthy, possibly lasting up to 24 hours.

Nonetheless, the network would certainly ultimately endure, drastically reducing the true harm an attacker can inflict. And for any PoS blockchain with a meaningful user base, we can be confident that there will always be some committed individuals worldwide who care enough about the network to unite, nullify the attackers tokens and initiate a network restart.

Furthermore, executing an attack could have a hefty price tag upwards of many billions. To certain powerful entities, however, depending on their motivations that price may be considered worthwhile if it means killing the network. With PoS, however, the cost is no longer the price tag of killing the network outright, but merely temporarily halting it. The stakes are massively reduced compared to PoW blockchains such as Bitcoin, and the anti-Sybil mechanism only serves to maintain the uptime (aka “liveness”), rather than the overall well-being (aka “safety”) of the network. This is also why Bitcoin is actually far less secure than people give it credit for, but that’s a conversation for another day.

A PoS blockchain’s level of resilience gives us an unparalleled level of assuredness in its long-term longevity, as it can now never really die, so long as there is belief of people around the world that it is meaningful (as cheesy as that sounds). This in turn gives a PoS blockchain an almost mystical status, one that lies above world governments.

This distinction also greatly lessens the necessity of committing a massive amount of resources to the anti-Sybil mechanism for the security of the network. The resources committed should ideally still be sufficient to discourage even the most powerful individuals from disrupting the network, but beyond a certain threshold the benefits of allocating more resources to the anti-Sybil mechanism plateau, because again, in PoS these resources only protect the liveness of the network, not the safety of the network. We definitely don’t, for example, need hundreds of billions to secure a PoS network in the way we’d need that much for a PoW network to be be considered reasonably secure.

Decentralization? Trust? Censorship resistance?

By this point, armed with the extra security bolsters PoS provides, we can start to get very confident that the permanence and leaderless consensus guarantees of mature blockchains genuinely cannot be derailed by anyone on Earth.

This characteristic is often encapsulated by saying that a blockchains’s core feature is “censorship resistance”, with the rationale being that naturally, if even the mightiest entities such as governments and corporations are incapable of undermining a blockchain, there’s an immunity to all forms of censorship.

Although I acknowledge the value in being able to subvert censorship, I don’t like this term. The phrase “censorship resistance” is charged and intertwined with ideas about our relationships to our governments and evading them, which is overly limiting and narrow.

When something reaches the level of permanence that a blockchain can offer, it becomes an enduring part of the digital landscape – something that will likely be persisting until the end of the internet itself. It becomes something that is simply there that we can all take for granted and rely on, like the ground beneath our feet.

Would we describe the ground as “censorship resistant”? Technically, it would be true, but it’d be a ludicrous thing to say since the ground is more than that – it’s a fact of this world we can all take as a given.

In the same vein, once something has been recorded on a blockchain, we can perceive it similarly as a ubiquitous part of the global digital landscape that we can all immediately take for granted.

Along with "censorship resistance", phrases such as "trust" and "decentralization" are often thrown around to describe the unique characteristics of blockchains. What's perhaps unclear to many is that these three terms are essentially three faces of the same concepts (leaderless consensus and hard permanence), albeit from slightly different perspectives:.

To illustrate, we can unify these three terms into a single statement: “given the decentralized nature of the blockchain, which operates in an absence of a leader, we can trust that no one has the power to revert its state changes, making the network’s consensus censorship resistant”.

Josh Stark, in his article Atoms, Institutions, and Blockchains, claims that this concept simply doesn’t translate smoothly into English, attempting to coin a new term – “hardness” – for it. It’s indeed kind of a hard thing to describe succinctly, which certainly adds to the existing confusion surrounding blockchains. Ultimately though, whatever we call it, it is the thing that sets blockchains apart from traditional digital systems.

There's a common perception, even within the blockchain community, that "censorship resistance" is the main function of the technology: a tool to create digital systems capable of undermining oppressive institutions and bypassing regulations. However, this again is limiting because blockchain technology has potential that extends far beyond this, specifically through a specific type of blockchains, which in particular have the ability to construct an entirely new class of digital infrastructure, unlike anything that exists today.

Let’s talk about those blockchains.

Part 4. Into the Ether

General purpose blockchains

At this point, I’m not-so-subtly hinting that using blockchains merely to track consensus of Bitcoin transactions isn’t that interesting nor using the technology to its fullest potential. Indeed, there is no magic rule saying that blockchains have to track money transfers or anything financial, another point that is often critically underemphasized. This probably sticks in people’s minds because of Bitcoin’s media fame, and how Bitcoin was designed to use blockchain tech to facilitate digital payments, using the blockchain’s token rewards as a literal currency.

Make no mistake, what Bitcoin achieved is indeed remarkable: it was previously impossible to transact digitally without a central authority, and it led people to question what money even is and who controls it, which is a good thing. However, to me it is disheartening that Bitcoin’s prominence has caused such a deeply intertwined association between financialization and blockchain, when it really represents a small sliver of what they enable.

We can and should experiment with more complex and interesting things for a blockchain’s state, but how can we actually do this experimentation? For years, the answer was challenging, as it would require creating an entirely new blockchain network to reach consensus on a new state, and then grow the network to ensure its security against attackers. This is clearly completely infeasible, wasteful, and severely limits the amount of experimentation and innovation we can do.

A major breakthrough addressing this issue came with the creation of Ethereum, a “general purpose” and “programmable” blockchain. Unlike Bitcoin, Ethereum’s state doesn't track consensus of a single thing; instead, its state mimics the internal state of a computer. Its protocol for mutating the state is then just a virtual machine, essentially a software environment that executes code in the same way a physical computer does. After all, at the end of the day code execution is nothing but simply a computer following a complex set of rules, or a “protocol”, to change some data.

With this innovation, now all we need to do to put something new under consensus is write code that the EVM (Ethereum virtual machine) can interpret, representing a desired state and its protocol rules, and submit the code to Ethereum (just as one would submit a Bitcoin transaction to the Bitcoin network).

Creating an entirely new blockchain to track consensus on a new experimental state is no longer needed, because once the code becomes part of the overall Ethereum state, as a byproduct of being part of Ethereum, it instantly inherits the same leaderless consensus and permanence properties of Ethereum itself.

For example, revisiting the hypothetical tic-tac-toe blockchain from before, Ethereum makes it such that we no longer need a new tic-tac-toe blockchain if we want leaderless consensus on a tic-tac-toe board. Instead, we can just write some code representing the board and its rules, submit it to Ethereum, and voila – that tic-tac-toe board now suddenly has the same guarantees as Ethereum itself.

With Ethereum’s programming language, which allows us to write code that is endlessly expressive (i.e. it is Turing complete), what we can put under blockchain consensus is now limited only by our imaginations.

A new computer

Programmable blockchains like Ethereum present us with a somewhat momentous occasion. For most of history, only influential figures like leaders of empires or religions could establish structures or processes capable of standing the test of time. But today, with programmable blockchains, anyone with internet access can create a digital structure that instantly ossifies into the foundation of the internet, to remain until the internet itself is no more (probably a long time).

Before we go further, it’s important to clarify an important nuance: when we refer to “permanence” in the context of blockchains, it doesn’t mean that we are using them to create structures that themselves are static and unchanging forever. Rather, only the changes to the state are permanent in blockchains – the state itself can be constantly evolving. Taking Bitcoin as a simple example, if I send you some bitcoins, the transaction itself is what's made permanent on the blockchain, and can never be erased from Bitcoin's history. Yet, the state of our Bitcoin wallets changes — my balance decreases, and yours increases.

Now, Bitcoin transactions are static and don’t really do anything once they are published, but with Ethereum it’s a different story. Instead of transactions, we add code to Ethereum’s state, and as we know code typically does things like performing computation, modifying data, etc.

So, when we put a program onto Ethereum, the program itself becomes a permanent part of Ethereum’s state, and it will stay “live”, indefinitely, executing exactly as its code instructs it to. No one — not even its author, me, you, or anyone else — can remove it or prevent it from behaving as its code dictates. That is what we mean when we say “permanent” in the context of Ethereum: while its programs may modify the state of data as instructed by their code, their existence and function remain unchanging and constant.

This gives Ethereum programs unheard of properties: they behave as if they’re just floating there, without any owner, faithfully following their written code, needing zero human upkeep, forever. It’s as if they have a life of their own, with autonomy granted by Ethereum.

The ability to effortlessly guarantee 100% uptime for a program alone is unthinkable in today’s software paradigm. Typically, programmers must constantly “nourish” their programs akin to a parent caring for a child. They need to feed it the right data at the right time to ensure it stays up and functioning, and tech companies hire a ton of highly-compensated staff for the sole purpose of ensuring that their systems remain online all the time. Moreover, traditional software can be modified or deleted by its developers at any time, for any reason. In Ethereum, both of these concepts are eliminated entirely, as both going down and changing are strictly impossible.

This is where blockchain technology really shines: by establishing a powerful new computing paradigm, not by just facilitating payments or creating cryptocurrencies. Ethereum essentially is a new breed of computer, one that kind of exists everywhere and nowhere at the same time, as if it were suspended in the sky, or the “ether”. It is not owned by anyone (or rather, is owned by many people all over the globe, including yourself if you like), hence there’s no access control – anyone is free to use it without any permission required.

Framed this way, how could blockchains not unlock a new generation of applications? We’ve basically unlocked an a new type of program running on a new type of computer, so it follows that we should be able to use these tools to construct new kinds of interesting systems that can’t be replicated by anything else we have today.

Unfortunately, however, most blockchain-based applications currently only exist as prototypes, articles and research papers (albeit compelling ones). And despite their potential, blockchains today have significant limitations: they’re inaccessible from most smartphones, incredibly slow, horrible UX, expensive, and challenging to implement privacy on. This lack of performance then gets magnified further when we compare it to the hyper-performant apps we’ve all grown accustomed to.

Naturally, “how to scale blockchains'' is consistently the main hot-button topic in the blockchain space, and is an ongoing unresolved war of ideas and theories that has yet to fully play out. Some disagree with Ethereum’s design and tradeoffs, leading to the emergence of other programmable blockchains, such as Solana, Avalanche, Cosmos and others, each claiming to be “better” in some way.

I’ll continue to only refer to Ethereum due to its cultural relevance, but just know that its name could be swapped with any other programmable blockchain, such as Solana, Cosmos, or any other alternative if we wanted.

No matter which way we slice it, a mountain of work remains before existing blockchain systems can enable high-performance systems that are ready to smoothly serve the masses. Years will be needed for the technical kinks to be ironed out and for “winning” designs to emerge. Despite the daunting nature of these challenges, it's crucial to remember they are ultimately nothing more than engineering hurdles, and there’s nothing fundamentally stopping a blockchain from eventually being super secure, powerful, and sustainably fast. Historically, humanity has proven its ability to overcome such engineering obstacles, so we can probably assume that given time, these too will be resolved.

Gas

Ethereum, like any computer, has finite resources and is bound by limitations on the amount of work it can do in a certain time frame. Therefore, we need to address an essential question: how does the network determine which piece of code gets executed and when? Generally speaking, Ethereum’s virtual machine can only execute one single thing at a time (there are parallelizable virtual machines too, but they generally still follow this same principle).

This limitation has implications on how we interact with Ethereum. It’s not like we can just let anyone execute any Ethereum code at any time without limits, because that would open the floodgates to an onslaught of spam. This, in turn, would prevent all other code from running, and brick the network entirely.

To illustrate this, what if someone wrote an infinite loop and executed it on Ethereum? The EVM, only able to run one thing at a time, would get stuck in this never-ending loop, rendering the rest of Ethereum’s state inaccessible, ruining the whole point of Ethereum.

To solve this halting problem (computer scientists love to grandiosely name “problems”), Ethereum employs a concept known as gas (a misleading name in my opinion), which is a tool meant to measure the computational effort required to run a piece of EVM code, and price its execution accordingly. Every single operation the EVM performs has a corresponding gas cost. For instance, the full EVM opcode cost list says that adding two numbers costs 3 gas, while multiplying two numbers costs 5 gas. This system discourages meaningless spam and the aforementioned infinite loop would no longer pose an existential threat to the network, since it would only actually run until its user inevitably runs out of gas to spend.

Conceptually, it’s as if the Ethereum state was a large vending machine, where the executable code items each have a set gas price. Simply send the appropriate amount of gas, priced in gwei (one-billionth of an ETH), and the desired code will execute reliably.

In the event that there are more pending Ethereum state transitions than can fit within a single block (which is almost always the case), an additional “tip” may be coupled with the gas payment, which is paid to the anti-Sybil participants once it gets solidified in a block, giving them an additional reason to participate in the anti-Sybil mechanism besides just receiving block rewards.

Earlier I alluded to the fact that some blockchain tokens actually do serve some intrinsic purpose. Unlike Bitcoin, whose value is solely derived from collective memetic belief, Ethereum's native token, Ether (ETH), is an example of this. Because Ethereum does not understand dollars or euros, gas must be priced in ETH, so its value stems from its unique function as the only thing that can “fuel” computations and operations within the Ethereum network, and thereby activate their key properties of permanence, autonomy, and ownerlessness.

Due to the current limitations of blockchain technology, there is usually a gigantic mismatch between the amount of people trying to access the Ethereum state at a given time and the amount of throughput the network can actually handle. This bottleneck means that today’s gas prices can be inconveniently (often crazy) high, which is a very valid and common gripe. Luckily, looking ahead as the aforementioned engineering challenges and technological hurdles are overcome, we can certainly anticipate gas fees eventually becoming far more affordable for the average user. In the “endgame” of blockchain development, it’s anticipated that interacting with the Ethereum network for an average person may cost no more than a tiny fraction of a typical internet bill.

Part 5. The Digital Commons

Coordination superhighways

So now we can build permanent programs that have no admin, execute by themselves, and cannot be unplugged. Great! But, what can we actually meaningfully accomplish in the real world with them?

I have been dancing around this topic for a while, but by this point, the answer should be somewhat obvious – digital collectible apes!

In all seriousness, though: we can create universally trusted, public digital infrastructure, which we can all rely on, depend on, and coordinate around.

Today's online platforms sit on extremely shaky foundations, subject to frequent changes and the whims of a select few individuals, who face little to no recourse for their users. With Ethereum, we can move away from this by building digital public infrastructure, owned by nobody in particular, that the public can trust will always behave in the same way — the type of trust that we simply could never place in any traditional private entity.

The way that we can safely trust and coordinate around these sturdy digital structures on Ethereum lets us view blockchains through the lens of being a novel coordination mechanism, one that’s native to the online world. I’d even go so far as to say that their properties make blockchains first and foremost a social technology.

I’m absolutely no anthropological expert by any means, but let me armchair for a moment: I have heard that a lens through which societal advancements can be looked at is through how they changed the way humans coordinated around (i.e. trusted) things. Pre-civilization, trust was more interpersonal, limited to familiar faces within distinct groups, where the supposed cognitive limit on the social relationships an individual could maintain, known as Dunbar’s number, acted as a limit to our collective accomplishments.

Over time, frameworks like law, money, and religion have enabled us to scale cooperation and trust beyond this limit. Blockchains represent a continuation of this progression, offering a new tool for scalable, trustworthy coordination in the digital age. The essence of these coordination frameworks — both analog and digital – lies in agreement and enforcement. Law and criminal punishment, religion and the threat of divine punishment, cultural norms and social shaming — all couple an agreement with enforcement.

In Ethereum, the "agreements" are embedded in the written code, which is designed to behave precisely as written. The enforcement is then automated, making it impossible for anyone to cheat the system outside the initial agreement. Unlike traditional social frameworks, (secure) blockchains are invulnerable to corruption.

This is obviously not to suggest that blockchains are unilaterally better than all other forms of social coordination. Rather, they have the potential to complement and compete with existing systems, enriching our toolset for societal coordination and trust.

You may have heard of the internet being referred to as the information superhighway, and there’s no denying that it has exponentially exploded our capacity to communicate with one another. However, our capacity to trust and coordinate in this digital era has not kept pace and still resides in the meatspace. We can conceptualize blockchain networks as addressing this issue by allowing us to construct new superhighways — not for information, but for coordination.

No longer does one need to establish a global religion or a nation to create a trusted institution for coordination. That power now rests with anyone possessing the creativity to construct a compelling framework, which can now be propagated at the speed of the internet, on a global scale. Provided that the initial design doesn’t encode unfair treatment, have extractive profit motives or perverse loyalties, everyone globally can immediately trust it to continue operating that way once published to Ethereum.

Revisiting the Byzantine general’s problem, or even prisoner’s dilemma-esque situations that happen all the time in the real world, the underlying cause of failure is often a lack of trust between to parties which prevents the coordination of individual actions for the sake of public benefits.

By creating structures that are autonomous and beholden to no single authority, Ethereum can minimize the need for interpersonal trust in some scenarios and address these types of issues. We don't need to trust each individual participant; instead, we place our trust in the nature of the network itself.

Returning to protocolization

“Coordinating around public digital infrastructure” is admittedly an incredibly broad concept, and there is a long list of thought-provoking and interesting ideas that blockchain advocates talk about that fall under this category, which I plan to expand on in the future.

For the purpose of this article, though, I want to consider the more “out-there” ideas out of scope and concentrate on what I believe to be the single most tangible, practical and compelling short-to-medium term vision for blockchain technology.

This vision stems from the fact that the structures Ethereum lets us build are strikingly similar to the foundational protocolized infrastructure of the early internet. Prior to the dominance of Silicon Valley, the early internet was largely designed by academics, fueled not by monetization, but more of an intellectually-driven vision of information sharing. This lack of intense competition (generally) fostered a general collaborative spirit, over time leading to the internet’s initial foundation to not be defined by proprietary tools, but by open protocols.

Open protocols are essentially standardized rulesets for performing common online tasks, such that interaction between two things operating on the same protocol can be universally comprehended. Examples include HTTP for loading web pages, SMTP for email delivery, and TCP/IP for basic network communication.

Each of these continue to underpin the internet to this day — you are probably already familiar with some of them, and one property they all share is that they aren’t owned by anyone, but rather are fundamental pillars of the internet, whose open standards are direct representations of the open and free design of the early web.

Now, these protocols didn't need a blockchain, like Ethereum, to establish their ownerless status. Instead, their academic origins and their slowly accrued legitimacy over multiple decades allowed them to eventually become completely entrenched as core internet infrastructure, something that is extremely unlikely to ever change. Any attempt today by a private entity to capture them would be viewed as absurd, and rightly receive significant pushback.

Fast forward to today, where the internet is significantly more corporatized. Imagine a hypothetical situation where we had to rebuild basic elements like web browsing and email from scratch — do you think it’d be more likely that we’d use underlying universally implementable protocols to power them like HTTP and SMTP? Or would we wind up with a handful of companies with proprietary standards in full control of internet browsers and emailing, free to manipulate these services at their whim?

Sadly, it’s just not nearly as easy to create and popularize a protocol in the current internet as it was back in 1990. Luckily, Ethereum and its capabilities presents us with a potential return to form, allowing us to rekindle this notion of protocolization that’s been lost in the privatization of the internet. This is because Ethereum programs can emulate (and even extend) the functionalities of early internet protocols.

The first key thing early web protocols and Ethereum programs share is that both are inherently ownerless and lie under global consensus. This property allows both to foster a trusted, rock-solid foundation from which anyone is free to build upon.

Again, the trust in early web protocols as a robust foundation stems from their widespread acceptance within the early internet community, and over time, these protocols became bedrocks for further developments. For instance, consider TCP/IP and HTTP, two foundational internet protocols that function in this composable manner. TCP/IP, a lower-level protocol, outlines the routing of data between points, while HTTP, a higher-level protocol used for transferring webpage data, strongly depends on the assumption that TCP/IP will remain a solid, reliable foundation for sending requests and responses between its client and server.

Ethereum introduces a similar dynamic, where one's work can be confidently built upon by others. The difference is, this trust is not derived from a long history of credibility, as it was with HTTP's dependence on TCP/IP, but rather from Ethereum’s immediate guarantees of consensus and permanence.

Supercharged open source

Building on each other’s work within the Ethereum context not only offers a platform for compounding growth but also a unique advantage: enhanced composability. Given that all content published on the Ethereum state is written in code, the integration process is super easy because with a single line of code, any existing Ethereum code can be referenced into another project. We are essentially are able to treat the entire Ethereum state as an expansive library of Lego-like code blocks, each capable of seamlessly connecting with the others.

This concept shares similarities with open-source development, where a project's source code is freely available for anyone to copy, modify, and distribute. However, there is a crucial difference when it comes to Ethereum. Technically, all activity in Ethereum happens on the same “computer,” so when Ethereum programs reference each other, they're not referencing a copied version, but the “real thing” in real-time — with no permission needed.

To highlight how huge this difference is, suppose Twitter open sourced their algorithm. With the composability Ethereum offers you could go beyond simply copying and using Twitter's algorithm in your own software, but instead directly interfacing with the live, real-time algorithm and all the data it's processing.

This means that anyone around the world with the motivation and skills could potentially make impactful changes to it and have them adopted in real time, as opposed to only the select few engineers who are Twitter employees. This type of composability on Ethereum goes beyond traditional open source and enables a creative outlet for all developers worldwide and empowers them to build freely on existing structures, put their creations to the test, and gauge community reception for themselves.

Clients vs. the current web

Early web protocols and Ethereum programs also share a crucial similarity in that they both must be implemented by someone. Revisiting HTTP and SMTP, while the protocols themselves are not owned by anyone, they also don’t just work by themselves. HTTP doesn’t serve web pages by itself, and SMTP doesn’t send emails by itself. They are essentially guidelines that need implementation. We still need people to build what’s called a client around the protocol to make a functioning service people can actually use.

Anyone is free to implement an open protocol with a client, and multiple clients of the same protocol interoperate and understand each other seamlessly, which is the beauty of using a protocol. This is why Chrome and Safari can talk to each other — they are both HTTP clients. Outlook and Gmail can understand each other in the same way because they are both SMTP clients.

The same concept applies for Ethereum programs. After all, they are floating in the “ether” – they aren’t themselves full blown applications that are ready for the web. They don’t come with buttons to click them, or screens to view them — those things must be built around them. Revisiting the tic-tac-toe analogy for a third time, our tic-tac-toe Ethereum program needs someone to build a client around it that lets you actually play the game by providing an interface.

What’s so great about this client/protocol model is that the amount of power any single client can wield over its users gets massively diminished. Take email for example; if Gmail were to mistreat or ban you, there are dozens of other SMTP clients you could choose to use. This broad choice is possible because the core protocol does most of the heavy lifting, making it relatively easy for people to develop SMTP clients.

As a result, users are less likely to tolerate BS from protocol clients. If Gmail missteps, you could switch to Outlook, and if Outlook disappoints, you could move on to another, and so on. Even in the worst possible case where every single SMTP client somehow colludes to screw you over, you can still use your own computer as an SMTP server. It’s literally impossible to get banned from email itself, or web browsing itself, and this freedom extends to Ethereum: users are able to use any client they want, but even in the absolute worst case they can connect to the Ethereum network directly from their computer and run a client that way.

This is in stark contrast to the large private entities that dominate the web today. They have managed to monopolize entire services and are essentially able to fully command entire sectors of the internet, which comes at a great expense to the quality of the internet itself. Nobody is explicitly forcing us to use these platforms, but once they become the hubs for most of the valuable activity, we as users become extremely coerced into tolerating the actions the leaders of these companies make, with the only alternative becoming fully abandoning that entire corner of the internet, a choice few are practically willing to make.

Since these entities are profit driven above all else, it only makes sense from their point of view that this implicit power dynamic between the platform owner and the user should not go unexploited. So naturally, exploitative, profit-extractive practices are freely implemented, which again, we as users tend to reluctantly put up with, lacking any real agency or alternatives to do otherwise.

This pattern has taken place in almost every major internet sector, but as an example let’s look at long-form videos, where YouTube is clearly in charge. As the unrivaled platform, YouTube can freely extract maximal profit at the expense of their users. Content creators, the lifeblood of YouTube, are beholden to an opaque algorithm that notoriously prioritizes quantity over quality, pressuring them to produce a constant stream of content, often at the expense of their well-being.

YouTube's advertising-based business model puts them in a position where they make maximum profit when viewers are kept on the platform for as long as possible, leading to a questionable promotion of content that is intended only to keep you online at all costs. Have you ever begrudgingly kept your eyes glued to a social platform before, not because you loved the content but because it was infuriating? Sensationalist and controversial material receives more visibility, which is good for advertising revenue but of course adversely affects information propagation, reinforces harmful narratives, and generally deteriorates everyone’s collective mental health.

Furthermore, YouTube has a unilateral ability to do whatever they want to their users and creators with zero recourse. Users and creators can and do get banned, demonetized, suspended, or otherwise treated unfairly at any time, for any reason. These actions are frequently justified by ambiguous “community violations,” and are often automated, triggered by enough reports against an account, regardless of whether these are from genuine users or bots.

Those affected then face an uphill battle of opaque appeal processes, which is also controlled by YouTube. Creators who make a living on the platform can experience an overnight demonetization and loss of their livelihood, and since YouTube also owns their social graph of followers, creators cannot migrate their followers to a separate service. Smaller accounts, in particular, can find their appeals falling through the cracks, given their lack of bargaining power. If you frequent a big social platform such as YouTube, odds are you’ve seen something like this firsthand.

This critique is not intended as a vendetta against YouTube. I recognize they don’t literally wake up every morning and ask themselves how they can exploit their users most sinisterly. Rather, these issues arise from a capitalistic environment in which platforms must prioritize profit maximization or risk losing ground to competitors who are willing to do so. YouTube is acting just as we can expect them to given the nature of the “game”.

I could have picked many other examples other than YouTube, as today's internet landscape features many dominant platforms, each exploiting their market power in unique ways. For instance, platforms built around payments or subscriptions may leverage their monopolization to charge excessive fees or to take substantial cuts from transactions. Platforms that own crucial data can revoke access at will, especially if they consider the sharing unprofitable. Twitter and (more recently) Reddit, are notable examples of this. Twitter initially allowed free use of their APIs, but later restricted access, killing many startups relying on the data overnight.

Stepping back, we see that our supposedly open and free internet doesn’t belong to us at all. Rather, we are renting our accounts and data from these platforms, who then charge us (directly or indirectly) solely for being the provider standing in the middle of trade, communication, or whatever else.

This business model of not using protocols, while less desirable for users, is certainly a more profitable one for corporations. The less agency and alternatives users have, the more profit they can then be leveraged for before they capitulate and leave.

Services such as email and web browsing are pretty much the opposite of this: they are comparatively unprofitable solely because they wound up being bound to open protocols, almost by situational luck, and this unprofitability is a direct byproduct of the fact that their underlying protocols do not (and literally cannot) extract any value for their function.

If email and browsing were being rebuilt today, though, it is highly likely that we would not adhere to this pattern, and would instead end up with one or a handful of proprietary “winners” who would then mimic the existing exploitative standard.

Now, if this is such an undesirable model for us, how then does this power and leverage get acquired in the first place? Consider the lifecycle of a typical tech startup: initially, the company bursts onto the scene with a compelling product, attracting users through appealing promotions or an interesting concept.

For paid services, prices are low with referral bonuses handed out generously, and for “free” services, the platform may initially feel fresh and interesting, without any notion of being taken advantage of in the air. Slowly, as the user base grows, the perks and quality of the platform begin to fade, until the platform ultimately becomes a far less appealing shell of its initial self. Prices creep frustratingly high, or perhaps the environment becomes toxic or otherwise exploitative in other ways. This happens so reliably that this decline in quality seems to have become an inevitable fact of the online world.

Maybe some examples of startups that went down this route just popped into your mind. This is because this phenomenon isn't imaginary; it's a business strategy. Those sweet deals offered in the beginning are unprofitable and hence unsustainable. During this stage, these companies are practically giving money away in order to attract users, often operating at a huge loss — a period that must eventually get phased out if the company wants to survive.

After all, their ultimate goal is not actually to provide us with some platform to make our lives better — it is to generate profit, same as any business. The goal is usually to use this “honey pot” approach to attract a big enough user base, and then once a network effect is in place, they are free to use that advantage to generate profit off of their users. Again, this could be implemented in a variety of ways: raising prices and fees significantly, running more advertisements, using algorithmic tactics to maximize engagement, etc.

Protocols do it better

If this all sounds bleak, know that there’s a bright side: with technologies like Ethereum, it doesn’t have to be this way anymore. Using its tech, we can finally make protocols again that are just as sturdy and resistant to centralized control as the ones like HTTP et al from the early internet. We can hit the escape hatch on this undesirable existing paradigm by using Ethereum to construct all of the protocols that should’ve existed, but were never created. Instead of simply renting our data, identities, social interactions, and experiences, we can shift towards collective “ownership” of them.

You may think that it sounds idealistic, naive or even plain stupid to believe there is a legitimate chance of challenging the powerful, highly capitalized incumbents of the web with some protocols and clients. Sure, we could re-envision existing platforms as clients of a fair underlying protocol — but how is this anything more than a pipe dream? It’s not like our current power players would exactly roll over and welcome disruption to their own systems, and while it’s a nice concept, the average person doesn’t care that strongly about any “free and open protocol ethos”.

That’s the thing though — if done well, this approach is not just ideologically favorable, but strictly better from an end-user perspective than what existing platforms are able to provide. When done right, protocol clients will gain usage not because of some compelling call to action about redistributing power on the web, but because they are better, with inherent, sustainable, long-term insurmountable competitive advantages over incumbent platforms.

Before we can examine what this advantage is, first we need to highlight why it’s even possible for Ethereum programs to be good enough to rival the core functionality of modern platforms in the first place. After all, it's one thing to have protocols for simple tasks like sending emails and loading web pages, but it's quite another to develop protocols for the complex tasks performed by today's popular applications.

Ethereum programs can do this because not only can they emulate early web protocols, but can extend their functionality beyond the reach of traditional protocols. Unlike the early web protocols, Ethereum programs are, as their name implies, programmable. While HTTP and similar protocols are more static, functioning as pre-agreed specs, Ethereum programs can be as long and intricate as developers wish to make them.

Additionally, just like any program, Ethereum programs are “stateful”, meaning they can remember things and hold storage, something the “stateless” early web protocols have no concept of. This similarity to full-fledged programs allows Ethereum protocols to theoretically achieve unlimited complexity. The Turing completeness of the EVM implies that, given enough creativity and careful engineering, we can develop Ethereum protocols capable of mimicking the core functionality of any popular existing internet service, as both are just collections of programs at the end of the day. With this, we can create systems with the best of both worlds: the open ownerless design of the early web, coupled with the advanced functionality of the current web.

As I stated earlier, traditional tech companies often face a downward spiral in quality due to one key issue: their need for continuous profit and returns to survive. However, Ethereum programs, as we've discussed, are autonomous, and don’t risk going out of business if they’re unprofitable. With zero cost for "keeping the lights on," they don’t have a financial achilles heel of constantly needing profit to continue existing.

Freed from this paradigm, they are able to be developed not only to mirror the core functionality of popular internet incumbents, but also to emulate the early web protocols and focus solely on providing their intended service without extracting profits from or otherwise exploiting users. As immutable pieces of digital infrastructure, we can be sure these programs will not change their tune on us once they garner enough users, and will continue working as initially designed no matter what, allowing us to safely congregate around it.

By performing a substantial portion of the work typically done by monolithic tech platforms, these protocols allow us to implement clients with higher quality standards. They can match the allure of the initial “honey pot” phase tech companies use to draw in users, but unlike these companies that can only maintain that quality until their funding dwindles, Ethereum clients can sustain that quality long term.

Creating each client would be straightforward relative to implementing everything yourself, since it wouldn’t need to involve much more work than making a slick interface and UI that wraps around the core protocol. This low entry barrier would empower teams worldwide to create arrays of clients, each of which could have different quirks but ultimately interact and compose seamlessly with one another.

In this landscape, no single client would wield significant power to exploit, as the core protocol itself (as part of Ethereum) is incorruptible, and even if a single client started acting badly, numerous alternatives would be readily available, with users even able to opt to run their own client if they desired.

With enough thoughtful design, this client/protocol model can be applied to disrupt nearly any conceivable corner of the internet today. Messaging, identification systems, social media operations, ridesharing, marketplaces, video streaming — you name it, the list goes on. All can be reimagined as fundamental services that are inherent to the internet itself, which is the “digital commons” that this article’s title refers to.

Having profit-driven private corporations control our physical public infrastructure such as our roads and highways is intuitively a bad idea when you ask most people. Is it not counterintuitive to accept this paradigm for our online infrastructure, upon which we increasingly dependent?

The term has been memed and bastardized into the ground, but “web3”, coined by Gavin Wood, a co-founder of Ethereum, originally was just a reference to an evolution of the internet where public services adhering to an Ethereum-enabled client protocol model become the most prominent structures online.

Financial protocols

Because Ethereum’s internal token holds actual monetary value, another power Ethereum and other blockchains have is that they allow for monetary value to be sent from person to person natively, without needing any central entity to facilitate the transaction. An interesting byproduct of this is that we can use Ethereum not only to create protocols that can replace existing tech institutions, but financial protocols can also be created with client implementations that could rival existing financial institutions, which are similarly (obviously) monopolistic and exploitative.

For a significant faction of blockchain advocates, this is the technology's primary, most crucial use case: creating a fairer, minimally extractive, alternative global financial system that operates without reliance on today's large banks and financial institutions. This topic is big enough to warrant its own separate discussion, and though finance and payments isn't my area of expertise, it would be remiss not to mention this potential application of blockchains here, at least briefly. Ultimately, the implications of Ethereum-based financial protocols pose the same potential benefit to us as the purely technological ones: the elimination of monopolistic practices, and moving ownership of core services away from centralized private entities and towards a collective general public.

Governance, adaptability & funding

Practically speaking, while Ethereum systems don't require maintenance once launched, they obviously do still need coordinated efforts for their initial development to get them off the ground. Incentivizing people to create these autonomous, often profitless protocols is a topic of ongoing discussion, and several funding mechanisms for these “digital public goods,” such as quadratic funding and retroactive public good funding are experimental ways of trying to achieve this. This is an entire topic on its own, but for the sake of brevity: while it might take time to refine how to best fund Ethereum projects, it’s not a fundamental roadblock preventing us from creating robust protocols. A promising statistic is that open source code that was written for free is already a significant backbone of today’s internet — estimated to make up over 70% of all active codebases today.

One might also naturally question how programs built on a technology like Ethereum, which emphasizes immutability, can remain relevant and adaptable in a rapidly evolving digital landscape. Ethereum programs do offer distinct advantages, but they also pose a unique challenge: once deployed, their code, including any bugs, cannot be changed or improved. This is a challenge, since the ability to add features and improve things is something that would be expected of any sophisticated platform. We still need to make sure we can adapt and progress the structures we build on Ethereum and allow client software that depends on them to improve.

Luckily, this rigidity does not leave us powerless or indefinitely tied to initial versions of projects. Those who wrote the initial Ethereum application are easily capable of drafting an improved or changed version, and then deploying it once again. Plus, there are other various techniques to create upgradeable versions of Ethereum-based systems, and then “lock” them once they’re proven to be stable, which is a bit out of scope here. No matter what technique is used, though, users always ultimately have the opt-in choice to transition towards new iterations, as previous versions will always continue to maintain their spot on Ethereum in perpetuity.

This doesn't mean we're stuck with a protocol once it's published. We have the flexibility to decide to switch to newer versions with improvements or additional capabilities, should they serve us better. The older versions will always continue to exist on Ethereum, readily available if needed. A well known example of this is Uniswap, a popular financial protocol that currently recommends you to use their v4, but v1, v2, and v3 remain live (and always will) for those who prefer to stick with them.

If there is no single owner of Ethereum programs, it also follows to ask who builds and maintains these platforms, who introduces new versions, and who adds new features? There are many options, but one interesting and widely adopted approach to decision-making for Ethereum-based platforms involves using a “decentralized autonomous organization”, or DAO. This is essentially an entity governed by a community rather than a company, whose core organizational structure is itself an Ethereum program with logic mechanisms for its members to propose, vote, decide and then implement changes to the protocol as they see fit.

The hardcoded rules of the DAO are just a starting point, and most DAO designs include mechanisms for modifying the DAO structure itself, allowing it to adapt over time to meet the evolving needs of its community (after all, we are just using blockchains to augment online coordination, not replace it entirely). Membership in a DAO can be defined in various ways, often including those who contribute value to the platform, be they workers, users, or technical contributors. Handling identity and voting in DAOs in a sybil-resistant way is another active area of research and development, specifically concerning the implementations of proof-of-personhood protocols and decentralized identifiers (yet another design space warranting its own article).

As a slightly more concrete example, imagine a hypothetical ridesharing protocol on Ethereum. This protocol would cover core ridesharing functions like calculating routes, matching drivers with riders, tracking rides, and facilitating payments. Various client teams could construct interfaces around this protocol, and if they were sophisticated enough, they would be able to provide a superior service to established companies like Uber or Lyft, since the absence of a corporate entity providing the core service would allow the client to operate at a minimal cost, letting them pay drivers more while charging riders less.

One option for managing this protocol would be through a DAO, which would serve to facilitate decision-making surrounding changes to the core protocol.

Perhaps a mix of willing riders, drivers, and programmers could use the DAO structure to agree on modifications — for instance, alterations in fare computation, rider matching, or dispute resolution methods. This could potentially allow these stewards of the platform to cultivate something that both strictly outperforms current options, and offers users and workers an unprecedented level of agency.

Obviously, issues like regulatory compliance, privacy, agility, and security would all be challenges a ridesharing platform like this would face and it’s not a realistic possibility with the Ethereum of today. However, as blockchain technology continues to evolve (and breakthroughs like zero knowledge technology allow us to bring robust privacy to blockchains), designs like this will continue to creep closer and closer to becoming a genuine disruptor.

Part 6. Conclusion

Grasping the whole elephant

There are a lot of assumptions surrounding blockchains that makes its common discourse resemble the parable of the blind men and an elephant, where a group of blind men learn what an elephant is by touching it, with each blind man feeling a different part of the elephant's body, such as the side or the tusk. Each man, limited to their singular experience, describes the elephant differently.

We can make a list that goes on and on, but to name a few parts of what people commonly feel when touching the “elephant”:

A means of creating cryptocurrencies and state-free money

A platform to bypass government oversight and resist censorship attempts

A conduit for creating scams taking advantage of those who don’t understand the technology

A casino in which to trade tokens with pictures of dogs on them

A means to create ownerless protocols that power a new class of internet services and disrupt tech monopolies

Tech to enable scarce digital images of monkeys

An instrument to design a reformed financial system without relying on traditional centralized financial entities

A tool to automate digital mass coordination and self-organize without a central leader

Each of these perspectives, while vastly different, all touch upon the same fundamental "elephant": blockchain, yet each viewpoint only reveals facets of the whole picture, just like the blind men in the parable (and hopefully the less savory perspectives detailed above will fade into irrelevance as the space further matures). We should understand blockchain not merely as the sum of these facets, but as a versatile technology that fundamentally provides two key elements: permanence and leaderless consensus. These attributes, used in some combination, serve as the keys to unlock each of these different points (and maybe more, who knows, I’m not the idea guy).

Friendly automation

Like all new technology, blockchains automate some kind of work that was previously done manually by humans. But, they are distinct relative to other tech advancements in that the level at which the automation occurs is different and disruptive. I think Vitalik Buterin, creator of Ethereum, puts it well:

“Whereas most technologies tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with the user directly”.

This isn’t just iterative technology that enhances existing processes to make them faster and better — it’s the kind of technology that questions the entire power dynamic by which we create software.

In an era where pushing back on entrenched power structures in any meaningful way can feel so futile, blockchains are one unexpected tool we have been suddenly bestowed with that can actually meaningfully tilt power asymmetry in favor of the individual rather than large institutions.

This potential to be one of the few tangible, practical ways to actually disrupt existing harmful power structures of the web by potentially obsoleting them is one of the most compelling allures of the technology, and is why I am so optimistic about the potential future of digital platforms running on blockchains.

A word on generality

Lastly, I want to re-emphasize the generality and programmability of Ethereum, after having heard an explanation by YouTuber Jordan McKinney that I thought was poignant. Paraphrasing the video, one oversight that a lot of people tend to make when thinking about new technologies that are “general purpose” is that there’s a nearsighted focus only on its applications in the present, and a struggle to imagine beyond into the realm of where things might go. It’s just kind of hard to appreciate the full power of generality, which is understandable, because if we are presented with a technology that someone says is “general”, or “can do anything”, there is no material “aha” moment that occurs in our minds.